Damp problems plague countless London homes. Homeowners often feel stressed when they find out their insurance policies don’t provide the coverage they hoped for.

The capital’s older housing stock, high humidity, and frequent rainfall create perfect conditions for moisture issues. These problems can cause serious structural damage and even health concerns.

Most standard home insurance policies don’t cover damp damage. Insurers usually see it as a gradual problem from poor maintenance, not a sudden accident.

But honestly, it’s not always that simple. Knowing when your policy might help, what types of damp could be covered, and how to protect your wallet can make a huge difference.

Most home insurance providers might not cover fixing the source of the damp, but they might help with some of the damage, depending on the specific circumstances. This guide tries to make sense of the tricky relationship between damp issues and insurance coverage, so you know where you stand before moisture causes chaos in your London property.

Key Takeaways

- Standard home insurance usually excludes damp damage from gradual deterioration or poor maintenance.

- You might get coverage for sudden water damage events that cause damp, but proving the cause matters a lot.

- Regular maintenance and quick action on moisture issues are essential for preventing damp problems and keeping your insurance valid.

Understanding Damp and Its Impact on London Homes

London’s climate and older buildings make moisture problems more likely. Climate change has led to more humidity and rain, so damp issues now pop up in both old and new properties.

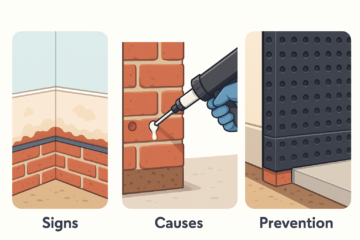

Types of Damp: Rising, Penetrating, and Condensation

Rising damp happens when groundwater creeps up through porous bricks and mortar. This usually means your damp-proof course failed or got damaged.

You’ll see rising damp on ground floor walls, showing as a horizontal band up to a metre high. Look for salt marks, peeling paint, and crumbling plaster.

Penetrating damp comes from water getting in through external walls, roofs, or windows. Damage or flaws outside your home let rainwater in.

Things like broken roof tiles, dodgy guttering, or cracked walls often cause it. Penetrating damp usually appears after heavy rain and affects certain areas instead of spreading out evenly.

Condensation forms when warm, moist air hits cold surfaces. Poor ventilation in flats and terraced houses makes this worse in London.

You’ll spot condensation as water droplets on windows, walls, or ceilings, especially in kitchens and bathrooms.

Common Causes of Damp Problems

Structural issues are the main reason for rising damp. Your damp-proof course might have worn out, been bridged by raised ground, or gotten damaged during building work.

Cavity wall insulation, if installed badly or damaged, can also let moisture in.

External factors are a big deal for penetrating damp. London’s drains can overflow during sudden storms, pushing water into homes.

Blocked gutters, bad pointing, or missing roof tiles let water in when it rains hard.

Lifestyle factors mostly affect condensation. Cooking, showering, and drying clothes inside add lots of moisture if you don’t ventilate properly.

Modern double glazing and insulation can trap humid air, making condensation more likely on cold surfaces.

Health and Structural Risks of Damp

Health issues from damp include breathing problems, allergies, and skin irritation. Mould thrives in damp spots and releases spores that can trigger asthma or make it hard to breathe.

Kids and older people are more at risk if they spend time in damp homes. Warm, damp places are perfect for mould and bacteria.

Structural damage from damp can threaten your home’s stability. Timber like floor joists and skirting boards might rot.

Moisture can also weaken brickwork, ruin plaster, and corrode metal fixtures. Condensation in the same spot over and over can cause serious weakening.

Salt deposits from rising damp expand and contract, causing even more damage to walls and decorative finishes.

How Damp Affects Property Value and Energy Efficiency

Property value drops sharply when damp is present. Untreated damp can really hurt your home’s value and scare off buyers.

Mortgage lenders might refuse loans for homes with bad damp issues. Surveyors who spot damp often cause buyers to lower their offers or even pull out.

Energy efficiency suffers when damp ruins insulation. Wet insulation doesn’t keep heat in, so you pay more for heating and feel less comfortable.

Condensation on windows and walls means heat is escaping. This leads to bigger energy bills and more risk of condensation damage.

Insurance issues get tricky if damp sets in. Many policies don’t cover gradual damage from rising damp or poor maintenance, so you’re left paying for repairs.

Home Insurance and Damp: What Every Homeowner Needs to Know

Most standard home insurance policies exclude damp damage from poor maintenance or slow deterioration. Sudden events like burst pipes might get covered. Knowing these differences—and keeping up with damp-proofing—can protect both your home and your insurance status.

What Is Covered by Typical Home Insurance Policies?

Most home insurance policies don’t cover damp damage since it’s usually seen as gradual wear. But you might get help for sudden, accidental events.

Potentially Covered Scenarios:

- Burst or leaking pipes causing sudden water damage

- Storm damage leading to roof leaks

- Accidental plumbing system damage

- Structural repairs after covered incidents

Some insurers may cover secondary damage like ruined plaster or wallpaper, even if they won’t fix the actual damp source.

Your buildings insurance usually covers the structure, while contents insurance protects your stuff if a covered event causes damage. Rising damp might get covered if you can prove you kept up with maintenance and your damp proof course was intact.

Policies vary a lot, so always check the small print.

Wear and Tear, Maintenance and Insurance Exclusions

Home insurance doesn’t cover problems from neglect or normal wear and tear. That means most damp issues won’t get paid for.

Common Exclusions Include:

- Old or broken damp proof courses

- Blocked gutters and downpipes

- Poor ventilation causing condensation

- Slow water leaks through walls

- Bad window and door seals

Not maintaining your home can void your insurance completely. Ignoring obvious damp or putting off repairs is a big risk.

Insurers expect you to do basic maintenance. That means clearing gutters, checking for leaks, making sure air can flow, and fixing small issues fast.

Penetrating damp is almost always excluded since it builds up slowly from building defects.

How Insurers Assess Damp-related Claims

Insurance companies dig into damp claims to figure out the cause. They want to know if it was a sudden accident or just slow damage over time.

Assessment Factors:

- Timeline: How fast did the damage happen?

- Maintenance records: Can you prove you’ve looked after your place?

- Professional surveys: Reports from damp specialists

- Photos: Before and after shots of the damage

Insurers want proof of maintenance before the damp started. Keep receipts for repairs and upkeep.

Claims adjusters look for signs of neglect, like broken gutters, missing tiles, or blocked drains. They might get independent surveys to pin down where the damp came from.

Your claim has a better shot if you can show the damage came from a sudden event—not just slow neglect.

Essential Damp-proofing, Repairs, and Preventative Steps

Stopping damp early protects your home and keeps your insurance valid. Regular maintenance is way cheaper than big repairs later.

Key Prevention Measures:

- Ventilation: Fit extractor fans in bathrooms and kitchens

- Heating: Keep indoor temperatures steady to reduce condensation

- Dehumidifiers: Use them in damp-prone rooms

- Guttering: Clean and fix it as soon as you spot problems

- Damp proof course: Check and maintain it regularly

Damp-proofing can cost £300-£600 per wall, so prevention really pays off. Get professional damp surveys to spot trouble early.

Fix small problems right away, like leaks or condensation patches. Regularly check downpipes, window seals, and roof tiles.

Good ventilation stops condensation-based damp. Open windows, use extractor fans, and don’t dry clothes on radiators unless there’s airflow.

Frequently Asked Questions

London homeowners face unique challenges with damp, thanks to the local climate and old housing. Treating rising damp can cost £300-£600 per wall. Insurance coverage for most damp problems is still pretty limited.

What are the typical costs associated with treating rising damp in homes?

Rising damp treatment costs can swing quite a bit depending on your property’s size and how bad the problem is. Professional damp-proofing usually costs £300-£600 per wall, but that’s just a ballpark and really depends on your home’s dimensions.

If the whole house needs treatment, you’re probably looking at thousands of pounds. Sometimes a specialist has to inject a new damp proof course or fit a membrane across all the affected spots.

There’s more to it than just the damp proofing, though. You might have to replaster walls, swap out damaged skirting boards, and redecorate rooms that took the brunt of the damp.

Don’t forget about ventilation—sometimes that’s another bill, but it’s worth it to keep the problem from coming back.

Do standard buildings insurance policies provide coverage for penetrating damp?

Most standard buildings insurance policies don’t cover damp damage because insurers see it as gradual deterioration. Penetrating damp falls into that maintenance issue category that sneaks up over time.

Your policy probably won’t help if the damp comes from poor upkeep, wear and tear, or was already there when you took out the insurance. Still, some insurers might help if you can show you’ve kept up with maintenance.

If a sudden event like a storm damages your roof and causes penetrating damp, your insurance might step in for repairs. Just make sure to tell your insurer about it right away.

Can home insurance policies cover the presence of mould resulting from water damage?

Mould removal coverage really depends on what caused it. If a burst pipe or some other sudden, unavoidable disaster leads to mould, your insurer could cover it.

But if mould grows from damp or just poor maintenance, insurance usually won’t help. That includes mould from condensation, rising damp, or water sneaking in because of repairs you skipped.

Some home emergency cover will get contractors out quickly if you have mould from a covered water leak. It’s always a good idea to double-check your policy and ask your provider if you’re unsure.

Is it safe for occupants to reside in a property affected by rising damp?

Living in a house with rising damp isn’t great for your health or safety. Dampness creates a perfect spot for mould, which can mess with your breathing and trigger allergies.

Over time, rising damp can even weaken the walls and threaten the structure of your home. It can ruin your stuff, too, and just makes the place feel pretty miserable.

It’s best to sort out rising damp quickly instead of just putting up with it. If the damp is really bad, maybe think about staying somewhere else until things get fixed.

Under what circumstances does building insurance cover the cost of repairing cracked render?

Insurance might cover cracked render if something like a storm or subsidence caused it. The policy has to list the event as something it covers, though.

If the cracks are just from age, weather, or skipping maintenance, insurers usually won’t pay out. They expect you to look after the outside of your place as part of normal upkeep.

If water sneaks in through cracked render and wrecks the inside, your insurer might pay for internal repairs but not the render itself. You’ll probably have to show you kept up with maintenance and couldn’t have prevented the problem.

To what extent does the Halifax home insurance policy offer protection against damp issues?

Halifax home insurance, like most standard policies, doesn’t cover damp treatment or damage from gradual deterioration. Most providers exclude damp as a maintenance issue.

Your Halifax policy might cover sudden water damage that could eventually lead to damp if you leave it untreated. This usually means things like burst pipes, storm damage, or some other covered event that lets water in all at once.

If you’re unsure, it’s probably worth calling Halifax to talk through your policy details or ask about any add-ons that might help. Policy wording can be tricky, so double-check your documents to be sure what you’re actually covered for.